AgentRem Core Features – Ready-Made Business Module

Manage remittance operations, track transactions, handle customer requests, and monitor agent performance seamlessly. Secure, efficient, and designed for your remittance business growth.

Manage remittance operations, track transactions, handle customer requests, and monitor agent performance seamlessly. Secure, efficient, and designed for your remittance business growth.

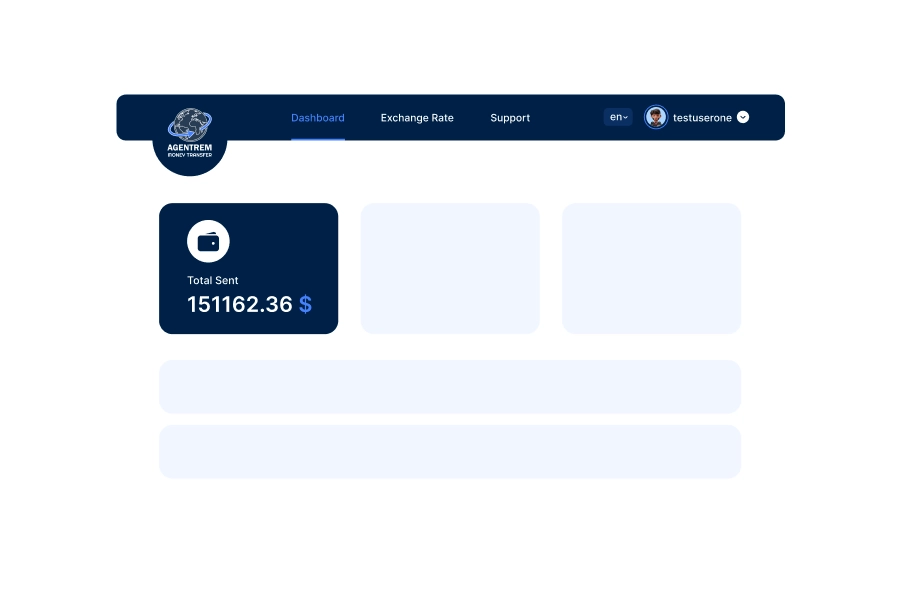

Easily see the total amount you've sent through remittance. Stay on top of your overall transfer history at a glance.

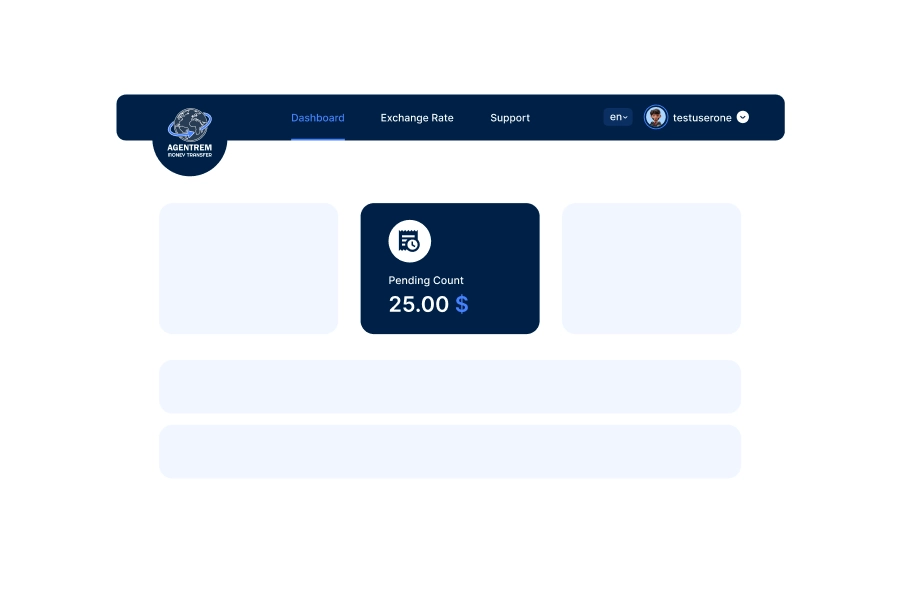

Quickly check how many of your remittance transactions are still pending — so you always know what's in progress.

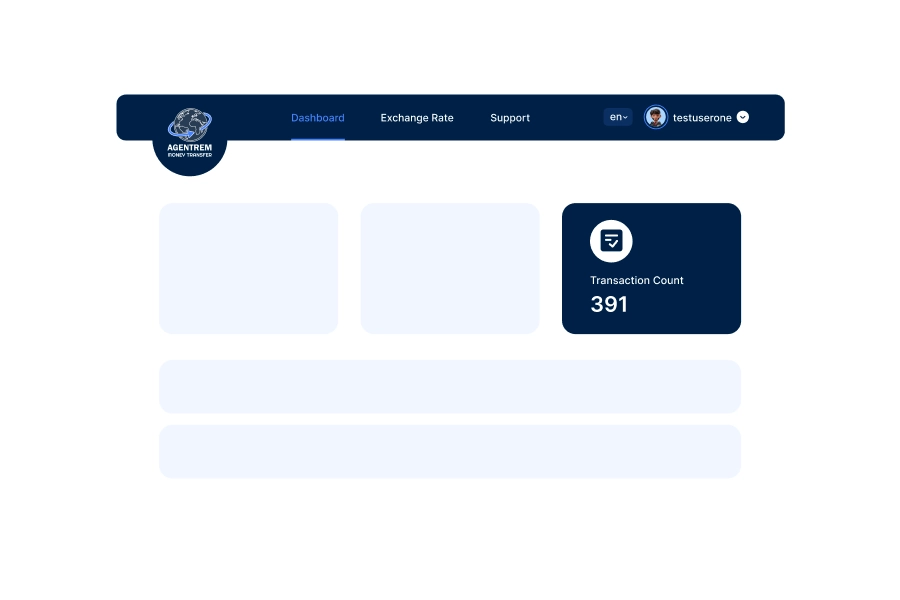

View the total number of transfers you've made, helping you track your remittance activity over time.

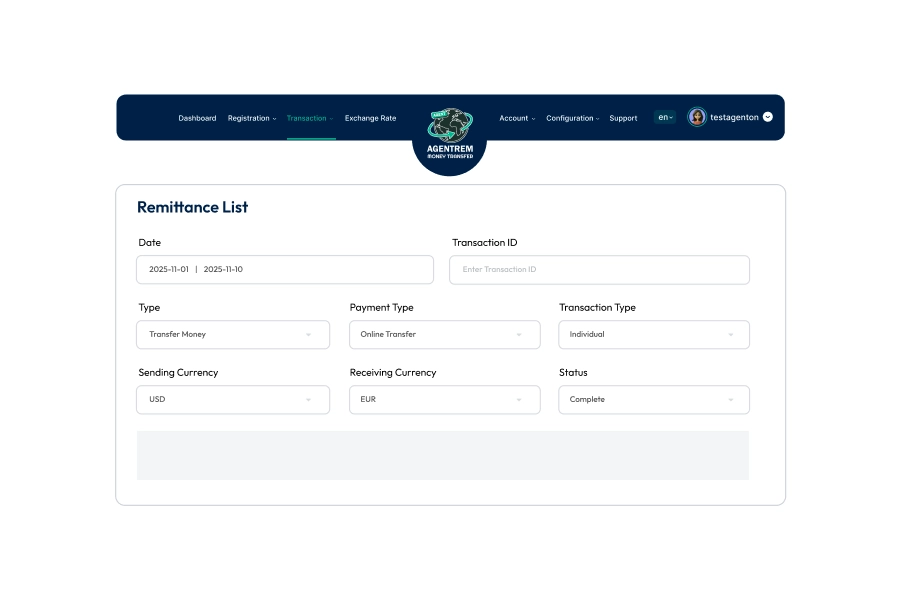

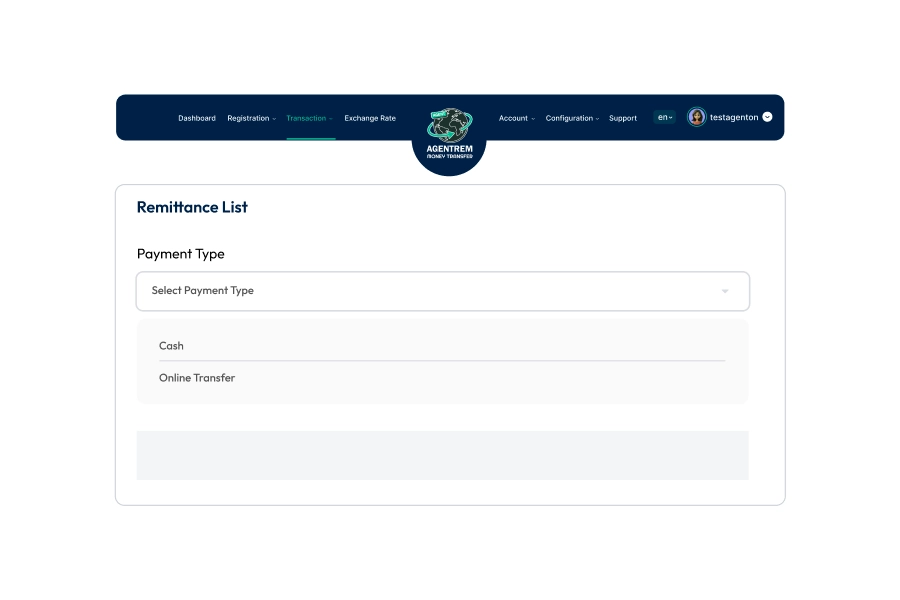

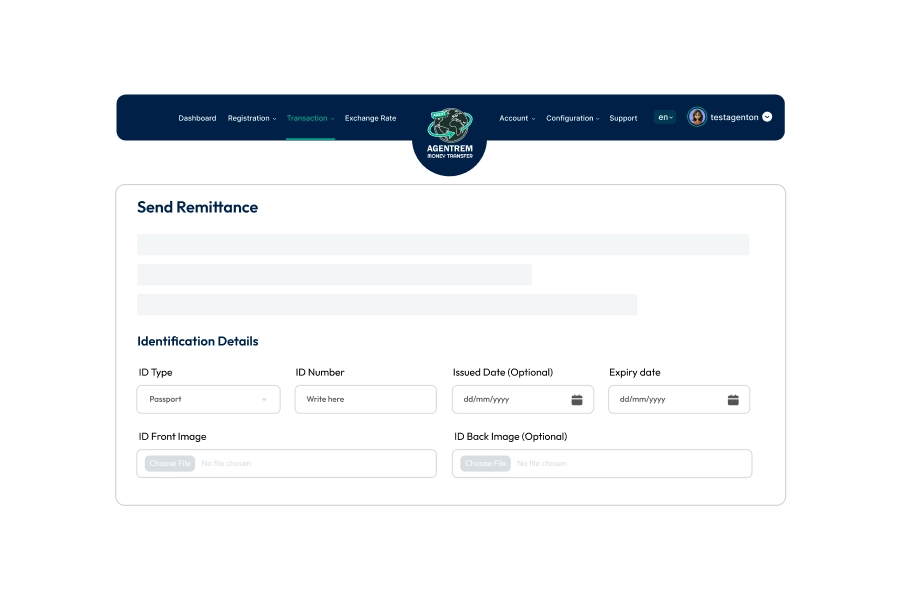

Easily handle customer remittance requests in one place. Keep track of every transfer with clear, real-time updates.

Sending agents can mark the transaction if this will be a cash payment or an online payment.

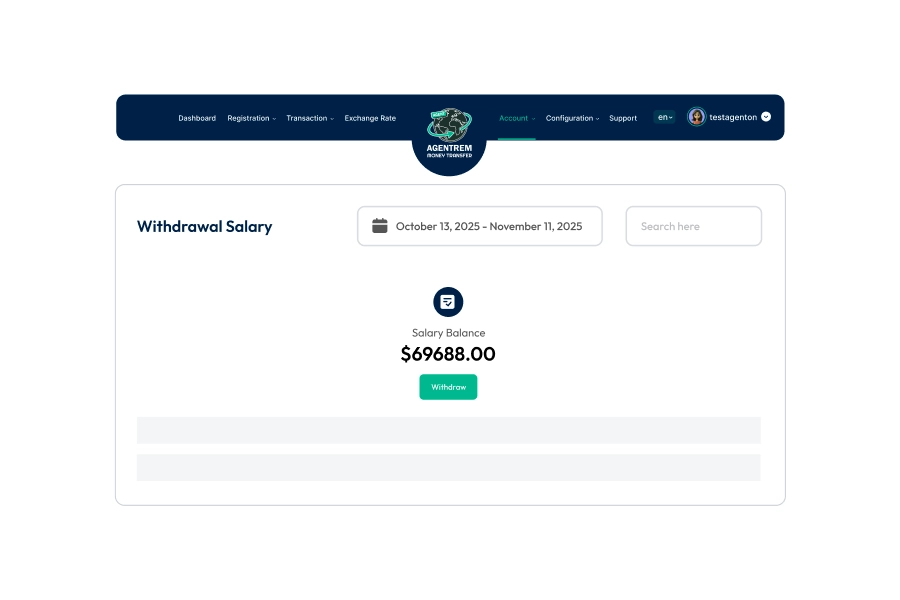

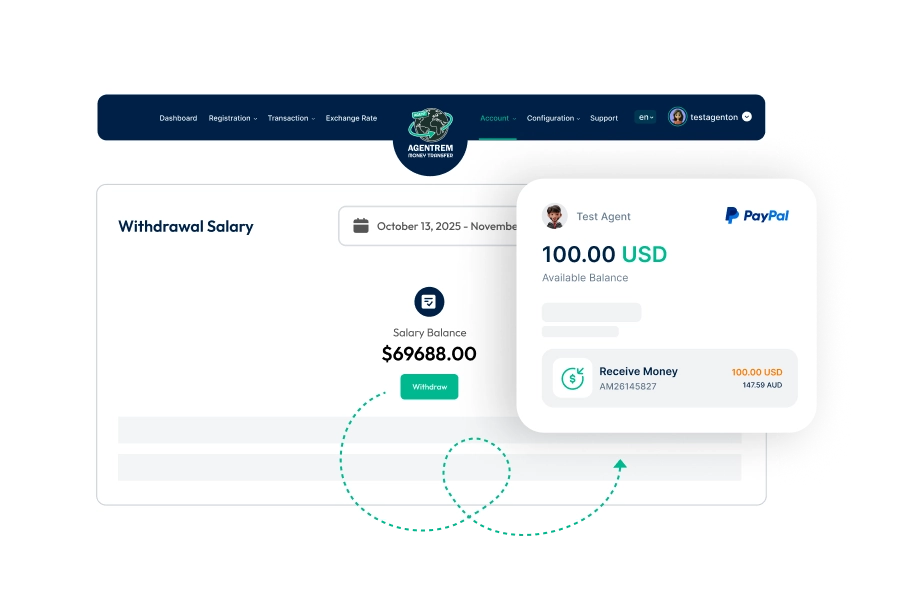

If you're a salary-based agent, your monthly income is managed and tracked directly within the system.

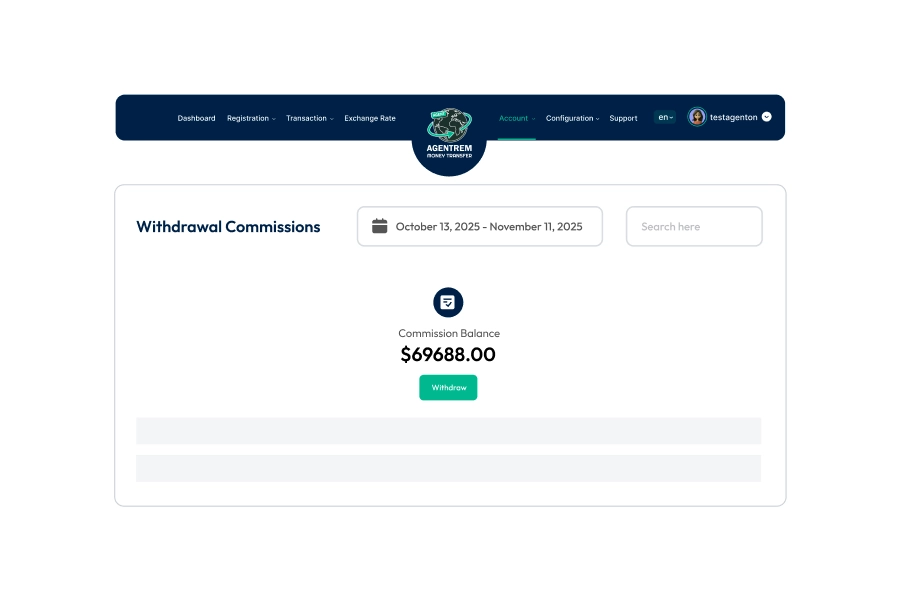

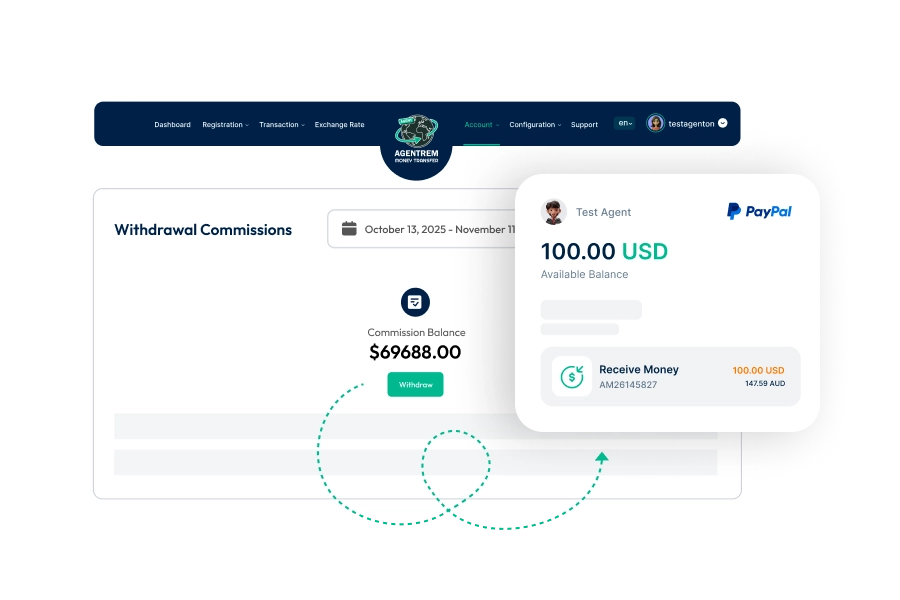

Earn commissions automatically for every remittance you process. The more you send, the more you earn.

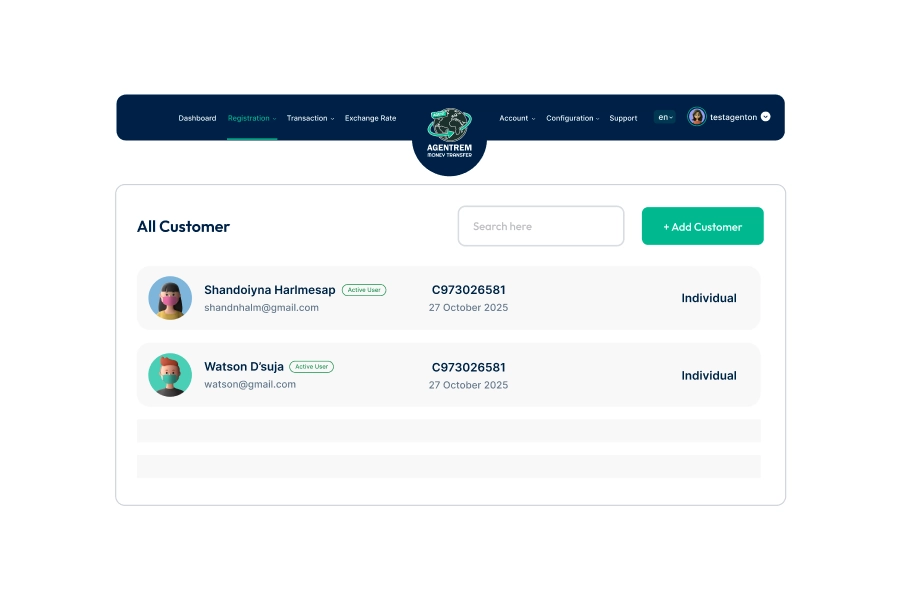

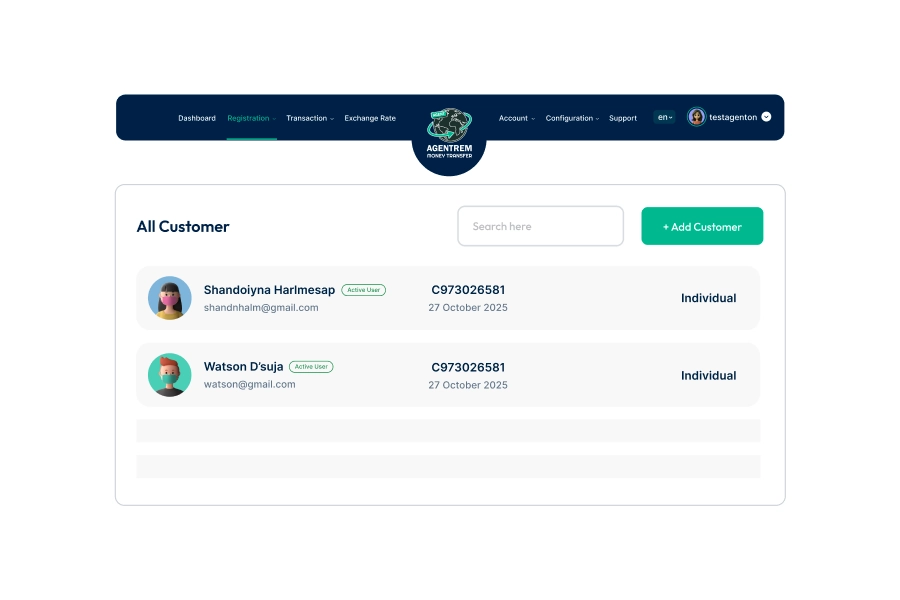

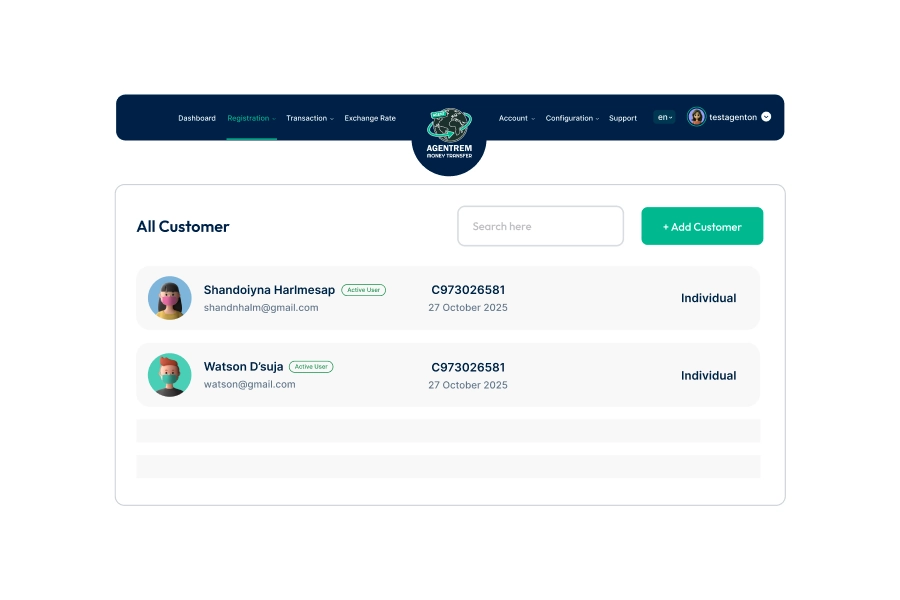

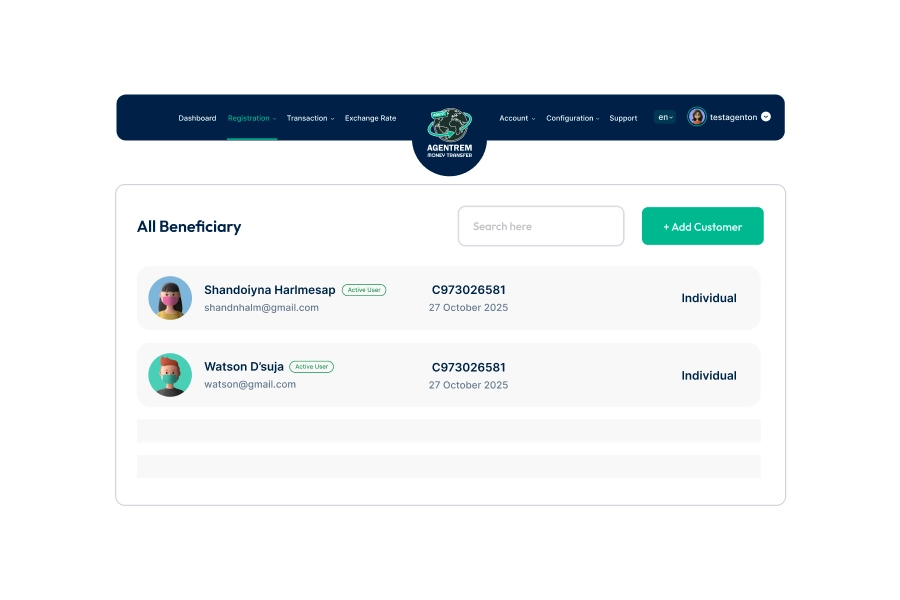

Manage all your customers smoothly in one dashboard — add new ones, view existing details, and assist them anytime.

Serve everyday users who want to send money to friends or family abroad.

Help businesses make international transfers for their employees, partners, or vendors easily.

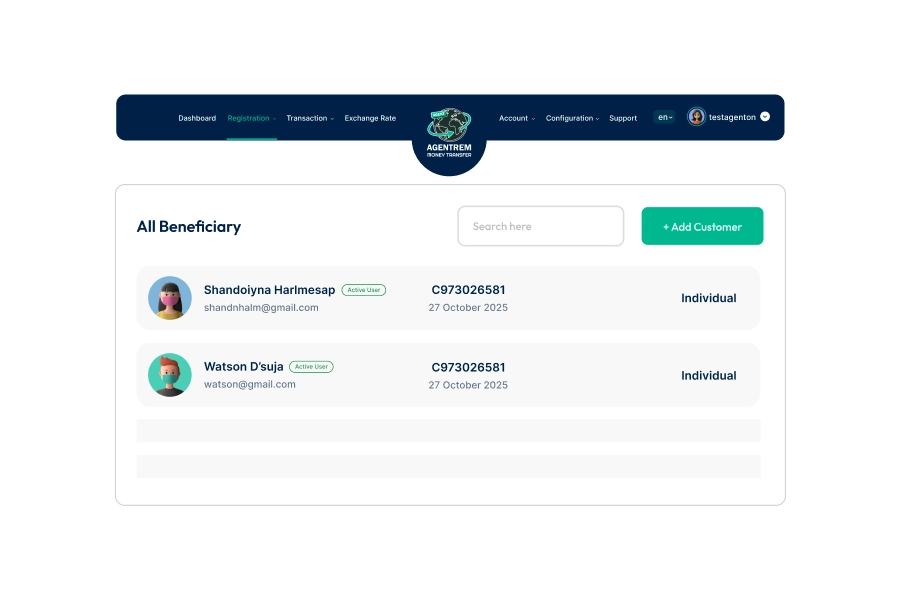

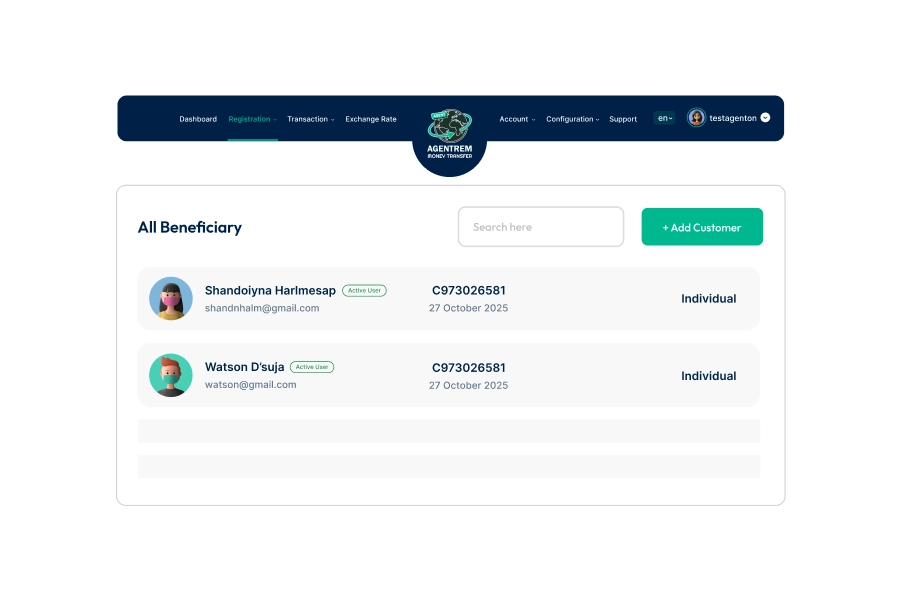

Handle all recipient details in one place — whether they're individuals or companies.

When the receiver is a regular person, their details are stored safely for easy repeat transfers.

If the receiver is a business organization, their information is managed separately for accuracy and compliance.

Salaried agents can withdraw their monthly pay quickly through the provided withdrawal methods.

Commission-based agents can easily withdraw their earned commission through available payment options.

If a transaction triggers AML (Anti-Money Laundering) alerts, the agent can verify and confirm details to ensure compliance and prevent issues.

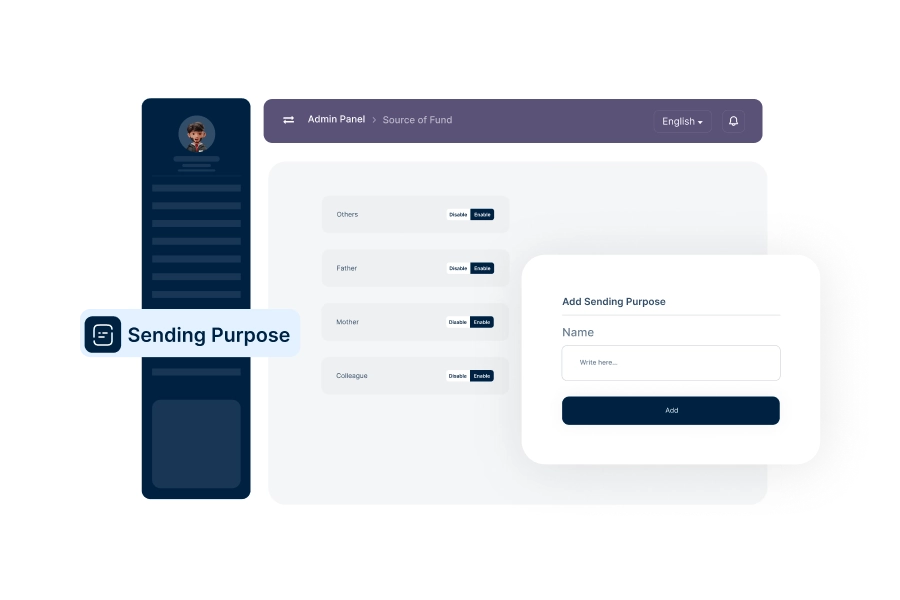

Create a list of purposes for sending money — such as family support, business payments, or personal transfers — for better record keeping and compliance.

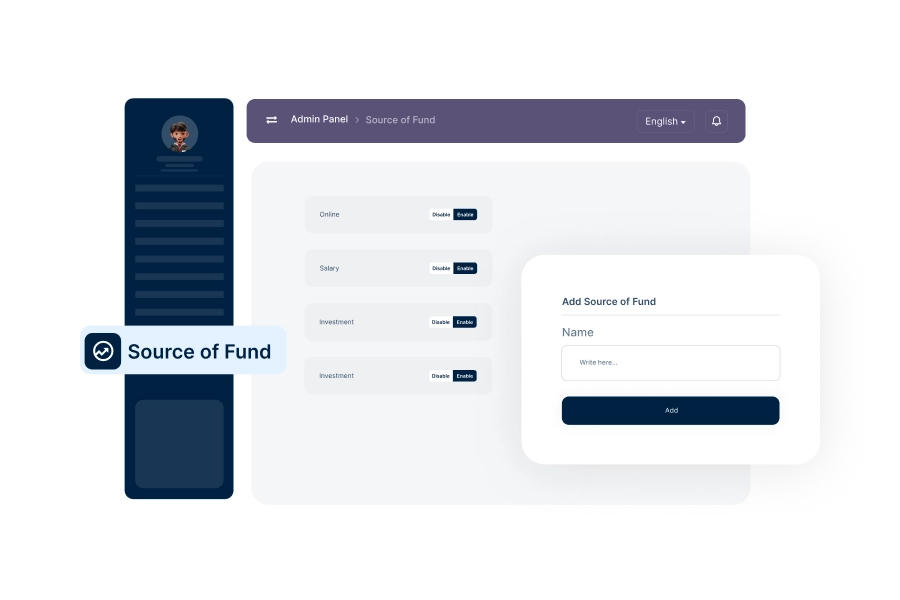

Define different types of fund sources (like salary, savings, or business income) to meet compliance and regulatory requirements.

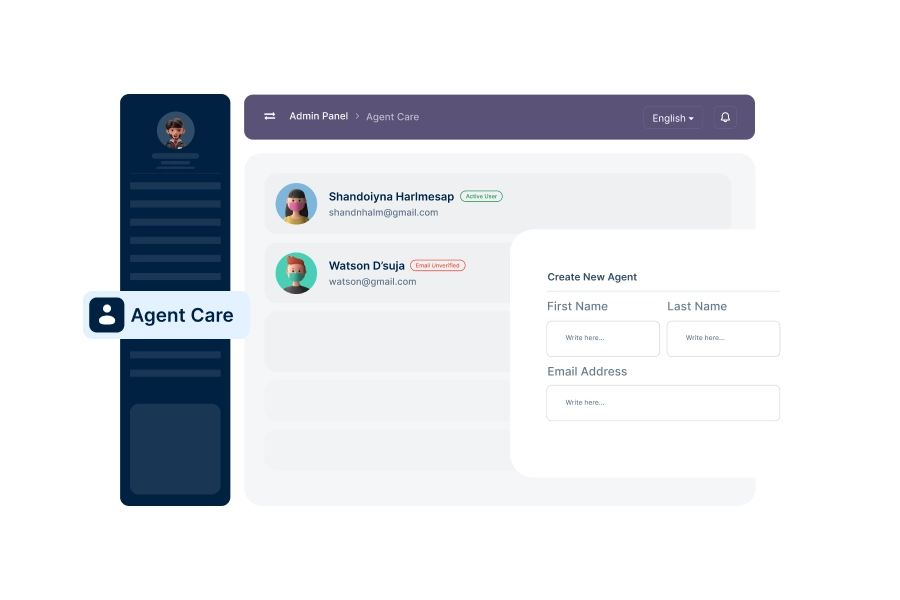

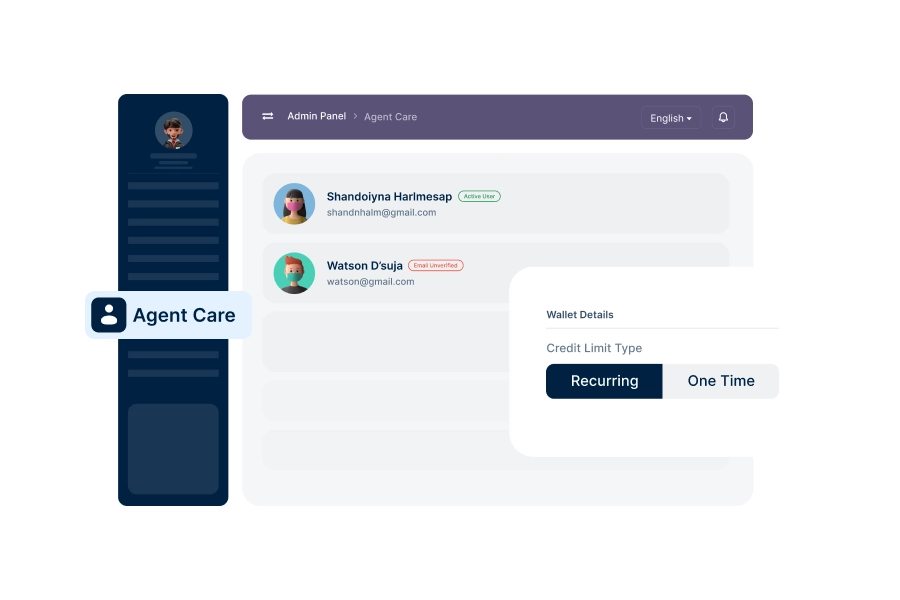

Manually add new agents directly from the admin panel. Each agent will be fully managed and monitored by the system.

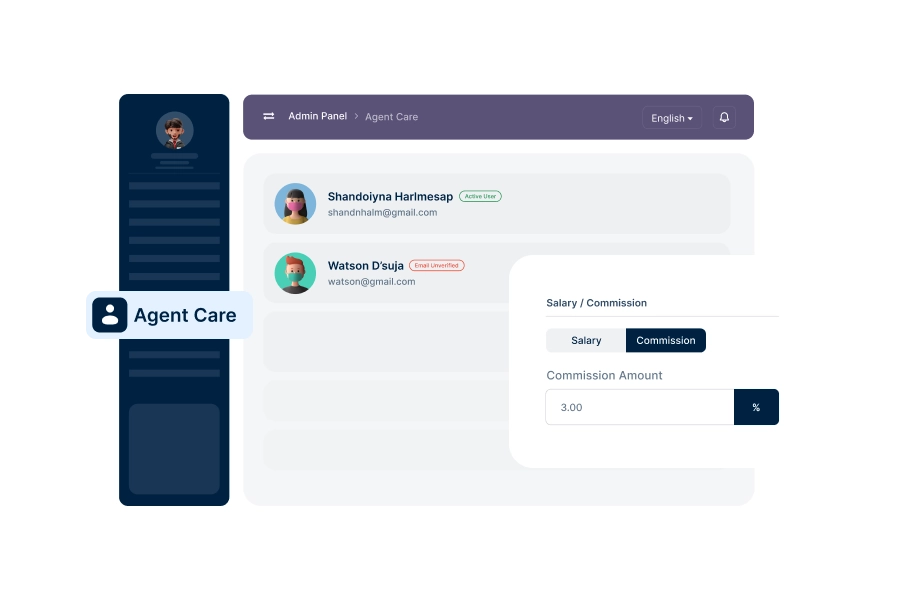

Decide how your agents earn — set them as salary-based or commission-based depending on your business model.

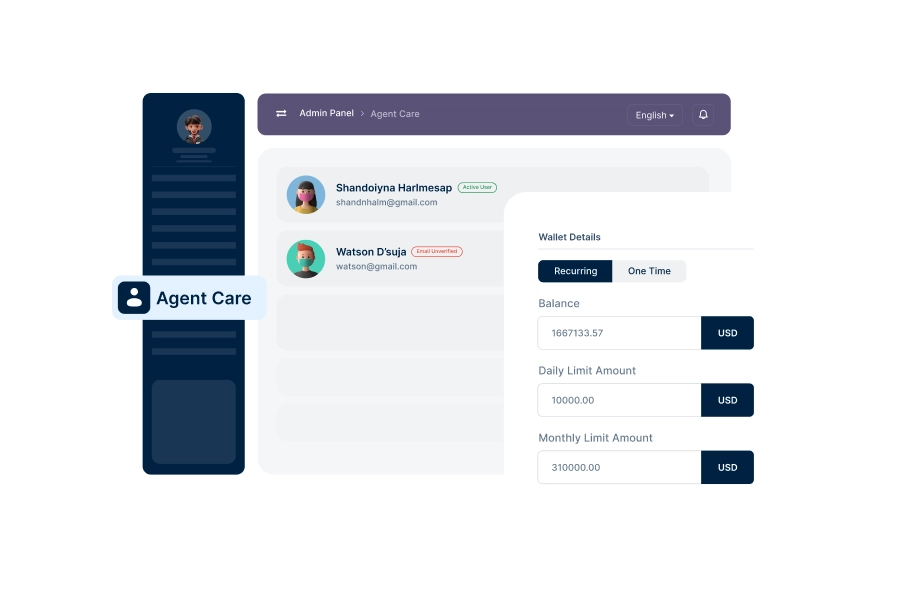

Choose whether an agent's credit limit is recurring (resets monthly) or one-time, giving you complete control over transaction capacity.

Assign each agent a wallet balance, daily transaction limit, and monthly transaction limit to ensure smooth and secure operations.

The complete solution for remittance agencies, independent agents, and global businesses managing international transfers.

Take full control of your remittance business revenue. Manage all fees, agent balances, and commission rules from a single dashboard.

Configure fixed or percentage-based service fees for every remittance transaction via the Admin panel.

Generate revenue by managing recurring or one-time credit limits and transaction capacity for agents.

Profit from the spread between global rates and your custom currency exchange rates set in the dashboard.

Control the earning flow between salary-based and commission-based agents to optimize your operational margin.

Apply automated charges whenever agents withdraw their earned commissions or monthly salaries.

Charge for specialized compliance handling and verification of business-level remittance beneficiaries.

Protecting your data with industry-standard security and regulatory compliance.

Ensures verified user onboarding and regulatory compliance through identity checks.

Protects APIs and authentication endpoints from brute-force and flooding attacks.

All financial operations are handled through encrypted and secured APIs.

Supports secure file storage with controlled access using local or S3-based storage.

All financial operations are handled through encrypted and secured APIs.

Allows restriction or approval of platform access based on IP addresses.

Provides fine-grained access control for users, agents, merchants, and administrators.

Provides fine-grained access control for users, agents, merchants, and administrators.

Maintains tamper-resistant logs for monitoring, reporting, and compliance audits.

Notifies users and admins of suspicious or unusual login activities.

Prevents bots, spam submissions, and automated abuse across the platform.

Ensures sensitive data is securely stored using database-level encryption.

Explore our range of cutting-edge solutions and purchase the best fits your business needs. Secure your script license directly from the CodeCanyon marketplace.

Personalize the app's feature, branding and user interface to match your business identity. Ensure compliance with industry standards and perform necessary security audits.

Conduct hrough testing to guarantee security and performance, then publish your app seamlessly on the App Store and Play Store with our expert deployment support.

AgentRem is a complete agent-based remittance management platform designed to help businesses manage agents, customers, and global money transfers securely and efficiently.

AgentRem is ideal for remittance companies, money transfer agents, financial institutions, and businesses that manage cross-border transactions or agent networks.

The platform includes powerful dashboards that let you onboard agents, track customer activity, monitor transactions, and ensure compliance—all from one place.

Yes. AgentRem supports multi-currency transactions, enabling seamless money transfers across different regions and exchange rates.

Absolutely. AgentRem includes integrated AML (Anti-Money Laundering) and KYC (Know Your Customer) verification tools to ensure every transaction meets regulatory standards.

Yes. Both agents and admins can monitor transactions in real time—ensuring transparency and faster issue resolution.

Yes. AgentRem includes responsive web and mobile applications, so agents and customers can access the system anytime, anywhere.

AgentRem uses bank-grade encryption, secure APIs, and multi-level access controls to protect sensitive data and transaction records.

Yes. AgentRem can be fully customized with your branding, regional settings, transaction limits, and reporting features.

Yes. Admin can view reports on agent performance, transaction volumes, and commission tracking in the admin dashboard.

Yes. Admins can assign roles and permissions to staff or agents to maintain full operational control and data security.

Launching AgentRem as your brand is simple. Purchase the script, upload it to your server, customize the branding, and configure the platform to suit your business needs.

Subscribe to receive product updates and exclusive discount offers straight to your inbox.